Category Archives

Larry LaBorde’s Articles

Mid-life Crisis

As my fiftieth birthday looms closer and closer, I am struck by the fact that in all probability my life is half over (or more). I find myself picking up books with titles like 500 Places to Visit Before You Die. I examine my life, thinking of things done as well as things yet to do. I list my life goals, work on a life plan for my remaining years and sit down to plan six trips to take in the coming year. Yep, this sounds like a mid-life crisis to me!

So I ponder my life and decide I have to make a few changes. I need to do something completely out of character, look death in the face and laugh. And then it hits me. I learned how to fly at 16 years old and occasionally would run across skydivers at the airport. My standard line to them as a teenager was, “You have to be crazy to jump out of a perfectly good airplane!” Now, however, it seemed like a great idea! Continue Reading

Honk If You Support Your Local Police

Recently in my fair city, an elderly man with an artificial hip that gives him trouble pulled up in a local park at 4:30in the afternoon and tooted his horn (twice) to get his brother’s attention to get him to walk over to the car. The older gentleman, who describes himself as a law-abiding citizen and a church-going man, was promptly subdued by our vigilant police force. Bypassing the issuance of a warning, an officer immediately wrote up a citation detailing the criminal’s activity. His heinous offense cost the horn-tooting villain more than $100!

You see, my city has an ordinance against unauthorized horn honking. A horn can only be sounded legally in an emergency situation or in a parade. I suppose the fellow is lucky that he did not get two citations totaling $200 since he tooted his horn twice. Maybe we should lobby General Motors to install little glass covers over our automobile horns with instructions to “only break glass in case of emergency…or parade.”

In view of overvigilant enforcement of laws such as the one forbidding most horn-honking, it is unfortunate that the Andy Griffith Show is no longer being produced for television. The recent scenario would have made an excellent episode in which an overeager Barney issues a citation for unauthorized horn-tooting to one of the citizens of Mayberry and Andy, in his calm, fatherly manner and Southern drawl, explains to Barney that “When we enforce silly little petty laws like that, we turn honest citizens into criminals and cause bad feelings between the people and the po-lice.” I can almost hear Andy now: “They’re good people, Barn, and they didn’t mean no harm. Now go on back out there and apologize.”

However, the way things work now is that those silly laws are enforced, revenue is collected and the citizens grow distrustful of the police. Often, the police then request and receive federal grants for programs to foster goodwill between the police force and the citizens it serves. Isn’t it lucky we live in one of the richest countries in the world? This type of logic would bankrupt a poorer nation.

My plan? I’m going to print up bumper stickers that say, “Honk if you support your local police.”

We need a little more Andy and a little less Barney.

Costa Rica: The Land without Mortgages

One of my favorite pastimes is traveling with my lovely bride of 35 years, Puddy. Several years ago, we traveled to Costa Rica for a business conference. Whenever we travel out of the country, I like to get a car and driver to drive us around for a day or so to point out little-known local places and items of interest. I enjoy the conversation as well as the local perspective.

As we toured the countryside, one of the things that struck me, was the number of partially completed cinder block houses. It was a mystery why so many houses had begun construction, yet appeared to be abandoned. There were not a lot of them, but there were enough to encourage me to ask about what I considered an oddity. Our driver and guide explained that mortgage loans were not readily available to most people in Costa Rica. If a young couple married and wanted to build a home, they purchased land outright, or their family gave it to them. The couple then saved their money, built a single room out of cinder blocks, and then moved into their new one-room home. Every payday, they would purchase as many cinder blocks as they could afford and start on the next room. The cinder block house would be built over a period of years as fast as their budget would allow. The use of cinder blocks allowed for exposure of the uncompleted room to Costa Rica’s hot and humid climate without damage. After many years, a simple but very nice home would be completed around an interior courtyard. The home thus would be completed without a bank mortgage and would be owned free and clear from day one. Continue Reading

Grandpere Hoss and the Treasury Agents

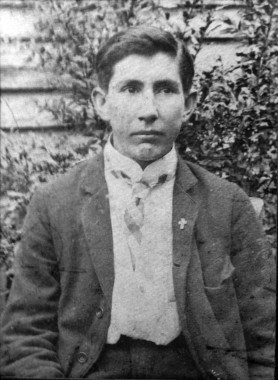

Grandpere Hoss as a young man at the turn of the last century, when he was still unknown to the Feds. This photo might have been taken to commemorate his participation in his church's choir.

Thanks to my sister-in-law’s interest in genealogy, I can now trace my family back to France on my father’s side, and I can trace my mother’s family back through Tennessee, Alabama and Virginia. My father’s family came to Louisiana in the late 1700s, when Louisiana had become a possession of France’s ally, Spain. If my fourth great-grandfather, Dr. Pierre LaBorde, had known that shortly Napoleon would become hard up for cash, retake possession of the territory and sell the entire place to Jefferson in the world’s largest real estate deal, I wonder if he would have made the trek at all.

Four generations later, in 1883, came the birth of my grandfather, also named Pierre and later nicknamed Hoss. Life in my grandfather’s day was quite a bit different; there was virtually no interface between the federal government and the common man, at least not in the bayou country of Louisiana. Grandpere Hoss didn’t have a birth certificate; a baptismal certificate worked just fine. He didn’t pay the required income tax and did not have a driver’s license. Even duck hunting did not require permission from the federal government until 1934, which was a good thing since Grandpere Hoss hunted ducks professionally during the Depression to provide food for his community. He lived his life completely off the radar screen. Having been held tight in Louisiana’s French-speaking community his whole life, he didn’t even speak English very well after four generations. Continue Reading

Hybrid Wind Energy

While listening to a talk about the feasibility of offshore wind energy, or to be more specific, the addition of wind turbines to abandoned offshore oil platforms, I was amazed that the speaker seemed not to have considered the transmission losses to move the electricity back to shore. The presenter said that his firm planned to install large electrical conductors inside the existing hydrocarbon pipelines. I just did not see how this would work out on any large scale for any long run of wire.

After giving the matter a bit of thought, I came up with a solution to the problem of moving the energy from wind power back to shore. This solution not only solved the problem for near-shore wind generators but also for far offshore wind generators as well. You see, the problems with electrical generation are transmission and storage. You lose quite a bit of energy in the transmission process, and the storage problem is terrible. The solution I thought up was simply using the electrical power on the platform to separate water molecules into hydrogen and oxygen through electrolysis.

Normally, electrolysis is not used to generate hydrogen because the power that can be generated by the hydrogen is less than the power required to generate the hydrogen. In the case of wind power, the cost of the electricity used to convert the salt water to hydrogen is not as important. Once generated, the hydrogen could then be transported back to shore inside the existing hydrocarbon pipeline to the existing hydrocarbon storage facility. The hydrogen could be stored and then burned in existing electrical generation plants when and where needed, in fuel cells or even in specially outfitted cars. Simple as that.

The setup would be to construct an electrolysis plant on the old offshore platform that could be efficiently powered by electricity produced from as many generators as could be fitted on the platform to convert seawater into oxygen and hydrogen. The hydrogen would then piped ashore via the existing hydrocarbon pipeline. The compressor on the platform (used to push the hydrogen to shore inside the pipeline) would be powered either by electricity or hydrogen. The hydrogen would be piped ashore and handled from there in much the same manner as natural gas. You would be therefore creating hydrogen fuel from water and wind power. The hydrogen could then either run fuel cells, electrical generation plants or even specially outfitted cars.

I am positive I’m not the first person to think of this solution, but if this is possible I wonder how many other opportunities we may have hanging out ready to be created from our leftovers.

Christmas: The Season for Stuff

Years ago I had the pleasure of hearing Don Aslett, lecturer and owner of Varsity Contractors, talk about the clutter in our lives. As the owner of one of the largest facility services firms in the United States, he has witnessed firsthand that a cluttered house can be almost impossible to clean. He went on to say that we have not only cluttered our homes with stuff but that we have cluttered our lives with stuff as well. Anyone interested in reading more about Mr. Aslett should seek out one of his classic books, including my favorite, Clutter’s Last Stand. In this book, he takes a look at the clutter in our homes and our lives and tells us how to get rid of it.

Years ago, late comedian George Carlin did a colorful routine in which he poked fun at our stuff. In the routine, he said that a marriage is a union of two people’s shtuff. It was funnier the way he said it, but it rang true.

All of us here in the United States love our stuff. From recent sales figures it seems that most of us like to buy our stuff at Walmart. Unfortunately, Walmart seems to get lots of its stuff from China.

(Disclaimer: this is not an article to bash China. On the contrary, I wish the country well in its move towards a free market economy. The recent history—comprised merely of China’s past 300 years—is a fascinating one. Anyone interested in learning a little about how China arrived in its current state would do well to read Clavell’s books Tai-Pan and Noble House. While they are good fiction, they are based on factual events. They examine the political upheavals that helped to shape modern China.)

Back to our stuff. The United States has been called “The Mouth” of the world. We consume more than anyone else on the planet. Please don’t get me wrong; I am all for reasonable consumption and a high standard of living. The problem, however, is that we are borrowing from our poor overseas cousins by having them continue to prop up the dollar and our national debt so we will be able to continue to purchase our stuff, most of which we do not even need. Only in the United States would someone charge an ugly sweater that no one will ever wear on his or her Visa card and then finance it for the next 10 years—long after it has been donated to Goodwill!

I believe a person or a country can spend his, her or its money any way he, she or it sees fit to do so. I just think that a person, or a country, is far down the road to ruin whenever it has to borrow money from others to buy useless stuff that it cannot afford to pay for out of its own wallet. How many of us have seen ATMs in fast food restaurants and movie theaters that allow the customer to get a cash advance from their Visa card to pay for their purchase? If you do not have the cash in your wallet to afford the burger or movie then perhaps you would be better off staying home and eating a sandwich and reading a book. There is good debt and bad debt, and almost all stuff purchased on credit is bad debt.

The U.S. even gave birth to a multinational e-commerce platform, eBay, to deal with our surplus of stuff, and eBayhas made quite a business out of recycling our stuff. As a matter of fact, if you have any stuff you are not using, then snap a photo of it and start selling it on eBay! Turn the clutter in your life that is going unused into family capital and become a capitalist.

After 9/11, we were told it was patriotic to continue spending and consuming. We were informed that if we cut back on our spending, we were letting the terrorists win. Some of my friends certainly tried their best to be “patriotic” during that period. While it is not my intent to bore everyone with a discussion of the velocity of money and how it impacts the economy, it is fair to say that consumer spending is only a part of the equation. We cannot consume our way into prosperity with borrowed money used to buy foreign-made goods. The ultimate result of that policy is a falling U.S. dollar and a lower standard of living.

In order for the United States to become a great country once again, we must save capital and reduce debt. Capital is used to build new factories that increase our productivity and allow us all to live better. The first part of saving capital is to stop borrowing money. The next step is to pay off debt. Finally, we must live below our means so that we can save capital for investment. Unfortunately there are no television commercials encouraging us to save capital. Commercials only promote consumption—and we are doing that just fine without additional help from Madison Avenue.

During the Christmas season we are bombarded with commercials luring us to spend more than we can afford. Before you go shopping, look around your house at all the stuff you already have and do not use. I have told my wife that she cannot bring anything else home until I measure and weigh it at the door. We will then have to go inside and find something of equal size and weight to dispose of before she can bring the new item inside. Without this precaution, the walls might explode.

I do not recall reading anything in the Bible about exchanging gifts during Christmas. Only the gifts of the three Wise Men are mentioned. Perhaps we should follow their example and limit our gifts to those given to God. It is His birthday, after all. And I am pretty sure that He does not want anything that you can charge on a credit card.

Waiting for the Crash

This chapter was published as an article in late 2004.

This past weekend I had the pleasure of accompanying my wife to LSU-Baton Rouge to visit my daughter who just this week was initiated into her sorority. We pulled our small Airstream trailer four hours south and enjoyed a delightful weekend visiting our daughter and relaxing in the perfect November weather of south Louisiana (clear blue sky, 68 degrees, sunny with a slight breeze). I even managed to finish Pat Buchanan’s new book, Where the Right Went Wrong: How Neoconservatives Subverted the Reagan Revolution and Hijacked the Bush Presidency.

Mr. Buchanan explains the foreign policy of post-World War II United States, a big part of which centered on monetary policy and the development of international organizations to head off the sorts of economic chaos that had occurred after World War I. It all started with Harry Dexter White’s plan at the 1944 Bretton Woods Conference in Bretton Woods, New Hampshire. White was an economist (and alleged spy) working under Treasury Secretary Henry Morgenthau.

Under the Bretton Woods plan, the U.S. dollar would serve as the world’s reserve currency and would be backed by gold at $35 per ounce. All other currencies would be valued against the U.S. dollar.

The plan also called for the establishment of the International Monetary Fund (IMF), funded with 104 million ounces of U.S. gold and billions of dollars of U.S. cash. Other countries contributed money and were granted voting rights in proportion to their contributions. The IMF was set up to provide loans to countries facing a run on their currencies.

A third part of the plan was the creation of the International Bank for Reconstruction and Development to provide loans to rebuild countries that suffered destruction during the war. The IBR&D would later become known as the World Bank.

After WWII, the United States sold the rest of the world twice as much as it imported. Since under the Bretton Woods plan, the U.S. was supposed to provide liquidity for the rest of the world, the trade surplus had to be addressed. Too much of the world’s money was piling up inside the United States. Several methods were used to send U.S. dollars throughout the world. The U.S. stationed troops and built bases around the world, which helped export dollars. Foreign aid and loans from U.S. banks sent even more money overseas. U.S. markets were opened to foreign goods with no import tariffs. Foreign currencies were devalued to make foreign goods more attractive in U.S. markets, enabling countries that were rebuilding to earn cash to pay back their loans. These techniques worked well, and pretty soon, the flow of money going out of the U.S. got out of hand. In 1971, President Richard Nixon and Treasury Secretary John Connally severed the gold link to stop the subsequent gold redemptions and allow us to drop the value of the dollar to match the currency value to that of our trade partners so that we could compete in the import/export arena. Nixon’s and Connally’s short-term thinking in unpegging the dollar’s peg to the gold standard has caused long-term pain and problems.

Following the U.S.’ dismantling of the gold standard, the International Monetary Fund changed its mission, loaning money to any country that found itself unable to pay back its loans, so long as that country pledged to follow IMF rules concerning its monetary policy, which came to include “easy money” policies and abundant quantitative easing and which put the banks in the position of having enormous power over some countries.

With the Reagan tax cuts and economic boom as well as the defense cuts at the end of the Cold War, the U.S. was, as a major funder of the IMF and a major purchaser of foreign goods, able to help “rescue” Mexico, Thailand, Indonesia, South Korea, Russia, Argentina and Brazil from currency collapse. The IMF and the World Bank poured money into these countries to allow them to continue servicing their foreign debts. The IMF insisted that these countries devalue their currency so they could export their way out of the crisis by flooding the U.S. market with cheap goods to earn U.S. dollars to service their loans. The U.S. agreed to keep its markets wide open. All this was done at the expense of the U.S. market.

With its trade deficit at more than $600 billion dollars, the U.S. is in trouble. U.S. dollars are piling up overseas. Unless the U.S. can substantially increase its exports (not possible given how cheap it now is to produce goods outside the U.S. compared to within it), then the U.S. dollar must fall. In the long run, a devalued U.S. dollar will help us export goods and correct our trade imbalance. In the short run, however, there will be much pain. There will also be pain for anyone foolish enough to be holding U.S. dollars.

Eventually, U.S. industry will reassert itself, but it will take a decade or more. First, the dollar value will have to continue to drop, followed by our standard of living. Eventually, people will be comfortable working for wages that make the U.S. competitive. Then, once our dollar is equal or below theirs, other countries’ goods will start to look relatively expensive compared to our own. We have basically engaged in a calculated race to the bottom, allowing multiple government entities and markets to determine where exactly the bottom is.

For now, we must import many essential items because we no longer make them in this country, and when the dollar devalues we will have to pay a much higher price for them until we can produce them again. Make no mistake: the dollar must devalue because of the economic strategy. Politically, a devaluing dollar will play havoc with our empire.

A couple of silver linings in this situation are that our troops may have to start to making their way back home because we will have less capital for the war games we tend to play. Our population may pay more attention to the character of the individuals they put in office. Incumbents may have to shape up or lose their jobs.

In the meantime, foreigners are buying U.S. assets such as Treasury securities and U.S. businesses. Our great U.S. companies are slowly being sold. Our country is being deindustrialized while we sit and watch.

Will there be a trigger that precipitates a dollar crisis? Will the system blow up? Will the Middle Eastern oil countries suddenly decide to sell their oil for Euros only? Will the dinar upset the U.S. dollar? Or will we the dollar die the death of a thousand cuts in which it slowly but steadily devalues?

When the dollar devalues, gold naturally goes up (unless it held down by artificial means). Over the past few years the dollar has dropped around 35% against the Euro and gold is up almost 70%. Maybe it is already happening before our eyes.

Live life and enjoy today because it is the only life we have, but be aware of what is happening all around us and take financial precautions. And remember: hard currencies work best in hard times.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

--From The Economic Consequences of the Peace by John Maynard Keynes

Postscript:

It is worth noting that in 2004, when this chapter was published as an article, gold was priced at $435 an ounce. Since then, it has risen to a high of just under $1900/ounce (roughly 430% growth) and has backed down to $1650/ounce (roughly 375% growth) at this writing (January, 2013).

Investing in Silver: What’s the Worst That Can Happen?

I made these observations in mid-2003. Back then, silver was roughly $5.00 per ounce, and many people thought I was crazy for what I was writing. Since 2003, it has risen all the way up to $49.00 per ounce and come back down to a more reasonable $25 per ounce. Junk bags are still worth their face value, but their cost is now 5x what they used to be, so at the time of this writing, you are only guaranteed a 13% return on your initial investment (October 2013)

That said, I still enjoy the dialogue between Will Rogers and Wiley Post and hope you will, too.

One thing hasn’t changed: silver is still a good investment.

If you are a “dyed in the wool” precious metals investor, then you can just go on to the next chapter. However, if you are still on the fence about making a purchase, then this chapter is for you.

One of my favorite investment stories is about Will Rogers. He used to say that few people have ever lost as much money as he and his pal, Wiley Post, had lost with their investments. As the story goes, Will Rogers was eating breakfast in a hotel dining room one morning when Wiley Post ran downstairs and said he had just talked with his broker on the phone. He told Rogers that this time his broker promised him that they could make it all up on this one oil deal, and they would get they biggest return on their investment ever! Mr. Rogers calmly swallowed his scrambled eggs, slowly looked Wiley in the eye and said, “At this point in my life I am more concerned with the return of my money than the return on my money.”

I believe that there are many people at a similar junction in their life. They are not interested in knocking one out of the park anymore; they just want to come through this downturn with what they have left intact. A money market fund, where many people stow their investment dollars, is a guaranteed way to lose with currency devaluation. If you read history, you will see that inflation is coming and there is no way to stop it.

So what is a confused investor to do?

What about an investment that is guaranteed by the U.S. Government not to go down more than 32%, yet still has an unlimited upside potential? It has all the upside potential of Enron five years ago, but with a guaranteed floor of 68% of your initial investment. It also has 5000 years of momentum going for it as well.

I am talking about 40% silver junk bags. These bags contain 2000 pre-1965 Kennedy half-dollars that contain 40% silver by weight. They are sometimes called clads because they only have silver on the outside with a non-silver core. A bag of these coins has approximately 295 ounces of silver in each bag. Currently these bags sell for about $1,472—including shipping to your door.

While the buy/sell, or bid/ask, spread is fairly high (about $.74/oz, compared to other silver investments that run from $.28 to $.55 per oz.) there is one advantage. If the price of silver drops 32%, you can just take your silver clads to your neighborhood bank and turn them in for face value ($1000.00) in Federal Reserve notes (dollars). There is your guaranteed floor on 40% junk silver bags. That is it; that is as bad as it gets.

On the other hand, if silver doubles in the next few years, you might get a +75% return on your original investment. The higher silver goes, the better the investment looks. What else can offer this little downside with an unlimited upside potential as well as act as a hedge against inflation?

A $10,300 investment will purchase seven bags, weighing roughly 55 pounds each, and totaling almost 400 pounds. While this much bulk (remember there is 60% base metal along for the ride) is hard to store, it is also hard for a thief to carry off while you are not looking. A single bag is a little bigger than a bowling ball. Imagine a thief trying to run down the street with seven bowling balls that weigh 400 pounds!

There are very few investments in the market today in which you can only lose a third of your principal and the chance to double your investment is a very strong and real possibility. Whatever you do, please don’t count out precious metals as a potential investment for your investment portfolio.

Dollars and Sense

Everyone needs to perform a net worth analysis on himself every few years. It is sort of an economic scorecard of how you are doing. It can be a depressing thing for many people since the stock market rolled over, but it is an exercise that is necessary for financial health.

Several years ago, Vice President Gore proposed that Congress increase taxes on millionaires. When asked to define a millionaire, he stated that anyone who made over $150,000/year was a millionaire. Talk about fuzzy math! Never confuse cash flow with assets. The simple traditional definition of a millionaire is someone whose net worth on paper exceeds one million dollars. Granted, since the Federal Reserve started devaluing our currency, it is much easier to reach that goal than in the past.

At any rate, if you simply go through your numbers and add up everything you own, subtract everything you owe –voila! – you’ll learn your net worth. If you are lucky enough to have a positive balance and are feeling extremely patriotic, let’s do some calculations using numbers from the U.S. government to see what else you could pay your fair share of.

The national debt currently stands at 16.4 trillion dollars. If we all just divide this evenly between all 319 million U.S. citizens (lots of luck there because we can guess who will pay the lion’s share of this one) you will find that your little family of four is responsible for $205, 600!

Our trade deficit represents current outstanding IOUs for our goods and services. This is sort of like a poker game in which you run out of money and then start using IOUs instead of cash. It is not a problem until a big pile of IOUs is presented for payment at the end of the game. Foreign governments, including China, Japan, the United Kingdom, Brazil and various oil-exporting countries hold IOUs, or U.S. dollars that have built up on their shores. Why do they hold our paper dollars, you may ask? They do this because our US dollar is the world reserve currency. Why you may ask? Good question! Perhaps it is because of the strength that our dollar used to have. Perhaps it is because they feel there is not a better alternative. Perhaps it is just a bad habit.

Many of the United States’ best friends in Europe hold a large number of these IOUs that are redeemable at any time. The total of trade deficit over the past 50 years (with most accumulating recently) is about $4.4 trillion dollars. If all these chickens come home to roost at the same time, we must pay them off with our goods and services. Again our family of four, paying its average share, should add another $55,172 of debt to its total.

The Social Security system also has a little problem called a large unfunded liability. If Uncle Sam had to operate under the same rules as everyone else, the state-sponsored retirement program would be devastatingly in the hole. This unfunded liability is over and above the national debt and is not included in that figure. Our average family of four should either add on another $105,000 or another $257,000 of debt to its list of obligations, depending on which timeframe we care to consider. (The unfunded liabilities of the Social Security system are officially measured in two formats. The first is a 75 year projection, and the second is an “infinite” projection, which is more likely around 150 years. The government bean counters do this in an effort to shrink the observed number and assume someone else will be figuring how to solve this problem.)

There is more bad news, but I think you are starting to get the picture. We are either up to $252,000 or $404,000 in Federal government debt for our family of four’s share of the burden in this country’s debt. Our founders started this country in mortal fear of large government. The prospect of seeing profligate government spending is one reason why.

There is a way out of this mess. As a country and as individuals, we can live below our means and work off this debt. We can push back the retirement age and all work longer. We can scrutinize every dollar the federal government spends and slowly take our medicine. It will take decades of belt-tightening to work our way back, but it can be done with collective determination and will power. It will require politicians to become statesmen who vote for the good of the country and not for their next election. “Bringing home the bacon to my district” will have to become a dirty phrase. Politicians will have to talk about how much money they are not going to bring home to their districts, and the voters will have to cheer on their efforts. The new political phrase will become, “Please do not leave a big bill for my grandchildren to pay.”

Of course the weasel’s way out in the short term is for Washington to just keep on spending, borrowing, taxing and printing more money. Or as we say in Louisiana, Laissez les bons temps roulez! (“Let the good times roll!”) At least for a little while longer—until the wheels finally fall off.

Chicken Dollars

I have been an avid reader of Gold-Eagle.com for several years now. The results have not only been enlightening but also profitable. I have enjoyed all of the authors’ contributions, from commentary about the wisdom of British Prime Minister Gordon Brown all the way to the passion of Doug McIntosh. I feel sometimes that we are guilty, however, of preaching to the choir. For that reason, I have given a series of talks about the subject and nature of money to my local Lions club. The following essay was an attempt to illustrate the workings of the Federal Reserve to fellow Lions. Since I spoke during our annual chicken dinner fundraiser, I just could not resist having a little fun.

“As you know, every year we print up a bunch of tickets for charbroiled chicken, which I would like to refer to as ‘chicken dollars’ for the purpose of this hypothetical anecdote. You see, when we trade these chicken dollars for five Federal Reserve notes, we are issuing a promise to pay in chickens. Our chicken dollars are actually backed by buyers’ full faith in our Lions club to deliver a chicken on demand.

“Let’s just say for the sake of discussion that we decide to cook every Saturday and issue the resulting charbroiled chickens for redemption. Every week, we sell 500 tickets for $2,500 dollars, and we cook 500 chickens.

“Now, what happens if we notice that not everyone collects his or her chicken dinners on the Saturday after purchasing his or her chicken dollars? After all, people go out of town, get busy, forget and so forth. Let’s say that to accommodate these circumstances, we make our chicken dollars redeemable for any Saturday with no date specified on them. I’ll bet that pretty soon, we could start selling an extra 100 tickets per week, or a total of 600 tickets, for $3,000 dollars and still only cook 500 dinners per week. The extra 100 tickets would represent a promise to pay sometime in the future. Another way to look at this would be as an interest free loan.

“After a while, since the chicken dollars did not need to be redeemed for chickens on a certain date but were good for chickens on any Saturday, we might notice that quite a few chicken dollars were outstanding and out in circulation. They might begin to be used in new ways. Perhaps the gardener cut your grass and, finding yourself short on cash, you decided to just pay him in chicken dollars. After all, each ticket is worth $5.00 (or a chicken dinner) any time he wanted to redeem them. We might find ourselves swapping chicken dollars for things like haircuts, hamburgers or even tips. These chicken dollars are now becoming a form of currency.

“This is getting pretty good now! People are now using our chicken dollars in trade, and they are redeemable on any Saturday, and we are issuing more chicken dollars than are being redeemed for chicken dinners. We are doing pretty well here!

“Now we might decide to get the Mayor involved in the club and talk him into accepting chicken dollars in payment for city sales and property taxes. If he likes the idea, our chicken dollars will become a form of legal tender (as opposed to chicken tenders).

Now things are really rolling. People like the chicken dollars, and they are circulating as payments on all sorts of things. People are not redeeming very many on Saturdays for chicken dinners, so we fearlessly print even more! We decide that the new clubhouse that we always wanted but could not afford is now within reach. We get a quote from the printer to print up $500,000 (100,000 tickets) in chicken dollars to pay for a new clubhouse. The printer wants $500 to produce the tickets. No problem! We just change the order to $500,500 and order the tickets to be printed. We then take $500 dollars’ worth of chicken tickets and pay the printer, then find a contractor to build our new clubhouse that we can pay in chicken dollars. By using our ingenuity, we have stumbled upon a way to issueinterest-free notes.

“As long as we do not have a run on chicken dinners we are in great shape. Soon we find very few people are redeeming their chicken dollars for chicken dinners any longer. In order to maintain faith in our chicken dollars, however, we still have to have a few charbroiled birds out there on Saturdays just in case someone comes by to redeem his or her chicken dollars. We even contract with a cold storage facility and store surplus chicken dinners, creating chicken reserves.

“Someone in the club mentions that it could be a problem if everyone wants their chicken dinners one Saturday and argues that we should have 100% reserves in our cold storage facility to cover the entire amount of outstanding chicken dollars in circulation just in case. This member is quickly chastised with the explanation that statistically, it’s likely that no more than 40% chicken reserves are necessary at any given time and that further reserves are just a waste of chickens.

“Other Lions Clubs throughout the country have been paying attention to our phenomenal success and are starting to print their own chicken dollars. Soon, all of the Lions Club chapters meet and decide to open a Central Chicken Reserve Freezer Facility that will be the lender of chickens, or the last resort to protect against a regional run on chickens. Special refrigerated freight airplanes are secured to be on standby to rush Central Reserve Chickens to any Lions Club in any area of the country that might experience a run on chickens. Since we are now part of acentral bank, we can lower the reserves and print even more chicken dollars. This is great news, and we celebrate with a massive feast!

“Since only a few people have been redeeming chickens on any given Saturday, we fall into the habit of only cooking a couple dozen chicken dinners then stacking them next to a bunch of boxes filled with rubber chickens. In doing that, we instill confidence that abundant chicken dinners are on hand in case anyone wants to redeem their chicken dollars. This conceit helps people feel good about their chicken dollars. It can even be said that our chicken dollars are the envy of the world. Of course, who would want to redeem chicken dollars for actual chickens! After all, chicken dollars are much easier to carry around and spend on purchases than trying to swap actual chicken dinners for goods and services.

“Everything was going great until one day when suddenly everyone became hungry for chicken at the same time! All the local Lions Clubs quickly exhausted their small supply of chicken dinner reserves and in a panic called the Central Reserve Chicken Freezer Facility and requested chickens now! Unfortunately, the system was only designed to help with regional runs on chicken, and the Central Reserve was quickly exhausted.

“Panic set in.

“People ran down the streets crying, “Our chicken dollars are worthless!”

“This, of course, caused more people to attempt to redeem their chicken dollars, making the situation even worse.

“The worst case scenario had taken place; there was a run on chicken dollars.

“Finally the International Director of the Lions Club called a press conference and declared a Charcoal Pit Holiday. All charcoal in pits around the country grew cold. After a week, the International Director explained that due to the shortage of chickens in the Central Reserve Chicken Freezer Facility, chicken dollars would still be backed by chickens but would no longer be redeemable in actual chickens. Anyone who had real chicken dinners was ordered to turn them in under penalty of imprisonment.

After our chicken reserves were partially replenished, the International Director of the Lions Club announced that the chicken dollars were again ‘good as chicken,’ and even though the chicken dollars were no longer redeemable in chickens, they were still backed by chickens in the freezer.

“Later, chicken dollars were devaluated. Only one-quarter of a chicken, instead of one-half of a chicken, backed the chicken dollar, but not to worry: our chicken dollars are still sound and the envy of the world!

“For those of you who do not recognize it, this is the story of our U.S. dollar from inception to approximately 1935. As preposterous as this part of the story is, it only gets more outlandish. As the saying goes, truth is stranger than fiction. During the Great Depression, our own Federal Reserve, with FDR’s help, did almost exactly what you just read. Chickens or not, it’s enough to give you indigestion! Only the Federal Reserve can get away with a theft of this sort and not go to jail.