How To Grow Your Gold And Silver Bullion

With the zirp, (zero interest rate policy) savings and bonds are not paying any significant interest. In Germany some bunds are paying negative interest rates. Few stocks are paying big dividends and most pay none at all. Everyone is trying to find a decent return on investment without taking on too much risk. The old 5 ¼% savings account interest rates that never seemed that interesting in the past now look mouth-watering.

One of the problems with precious metals has been the fact that they do not pay any interest or dividends. In today’s ZIRP market that is becoming less of a problem. However, some people have done quite well trading the gold to silver ratio. Simply trading their gold for silver when the ratio is high and trading their silver for gold when the ratio is low has proven to be quite profitable in terms of more metal at the end of the trade.

When trading gold and silver back and forth you always have a position in either one or the other. The object is not to worry about the price of either metal but to simply accumulate more metal at the end of your trades. In a long-term bull market in metals you will end up on top if you have more metal at the end of the decade.

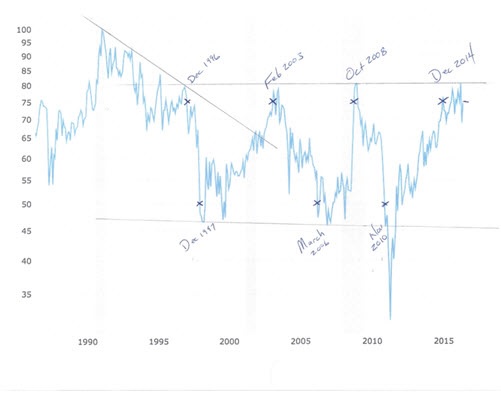

The chart of the gold:silver ratio shows a long term ratio over the last 30 years. For the past 20 years or so if you traded your gold for silver when the ratio was 75:1 and then traded your silver for gold when the ratio was 50:1 you would have made the following trades:

December 1996 trade 10 oz gold for 750 oz of silver

December 1997 trade 750 oz of silver for 15 oz of gold

February 2003 trade 15 oz of gold for 1,125 oz of silver

March 2006 trade 1,125 oz of silver for 22.5 oz of gold

October 2008 trade 22.5 oz of gold for 1,687 oz of silver

November 2010 trade 1,687 oz of silver for 33.7 oz of gold

December 2014 trade 33.7 oz of gold for 2,527 oz of silver

Unknown date trade 2,527 oz of silver for 50.5 oz of gold

Of course there would be premiums to pay depending on what form of silver or gold you purchased as well as sales commissions. These fees would make the trades less profitable than shown in our illustration but you get the general idea.

If you would have been careful enough to trade when the ratio was a little above 75:1 and a little below 50:1 you would have done even better. But why get greedy when these ratios are so easy to remember and execute? Just write them on the wall in big numbers and watch for them on the chart every few years.

At all times you would be holding a position in either silver or gold so you would still have a precious metals position throughout the entire time frame in either one or the other.

Also note that I did not pick the average tops of 80:1 or the average bottoms of 47:1. Tops and bottoms are hard to pick so I just chose a pretty conservative 75:1 for the top and 50:1 for the bottom.

If you have not swapped gold for silver in this current cycle you may still want to jump in and give it a try. Currently the ratio is around 73.3:1 and falling. So now you might want to hurry and trade some gold for silver. It is a pretty boring trade where you only swap every 1 to 6 years but with patience it can pay off pretty well for an asset that doesn’t pay any interest of dividends.

by Larry LaBorde

Elizabeth LaBorde

Latest posts by Elizabeth LaBorde (see all)

- Coal Fueled Teslas - October 13, 2017

- US Foreign Policy And The Long Game - August 14, 2017

- Full “Faith” And Credit - June 26, 2017

Larry LaBorde's ArticlesJul 24th, 20160 comments

Contact Us

24 Hour Spot Prices

Change Bid Ask {{item.name}} {{item.change}} {{item.bid}} {{item.ask}}

Product Prices These are our most commonly sold products, but we have many more!

Hover over product to see pricing.

|

{{product.name}} (*) (**)

US Price: ${{getPrice(product)}} Price Outside US: ${{getPrice(product, 'non_us')}} Ounces: {{product.oz}} |

* (15 oz foreign Min) ** (When available)