Category Archives

Larry LaBorde’s Articles

Coal Fueled Teslas

Several countries are making proclamations that state all new cars shall be electric by a certain date. Who decided on electric cars? I know they sound “clean” but where does that electricity come from?

About 30.4% of electricity in the United States is generated from coal. About 19.7% is generated from nuclear. So over 50% of the US power is from coal and nuclear. The remaining is as follows: natural gas = 34%, hydro = 6.5%, wind = 5.6%, biomass = 1.5%, solar = <1% plus other misc. sources.

While there are more engineers alive today than all during history there are several problems with electric cars that have to be overcome. Of course everyone knows that batteries are a problem. They are heavy, do not hold enough charge for long trips, are expensive and they are a problem to dispose of at the end of their service life. The electric motors themselves require rare earth magnets for high efficiency. You can induce an electric field without them but the efficiency suffers. Most rare earth magnets are mined in China.

One very big problem with mandating that all cars be electric is the grid. If everyone charged their cars at home at night the existing grid would not be large enough to handle the additional load. Not only would we have to burn more coal or build more nuclear power generating plants, we would have to upgrade the existing electrical distribution system (the grid) to service all the additional electric load that the EVs would require. Most older home electrical services would also have to be upgraded as well.

Government decrees seems to have decided things, however, decrees from on high are not engineered solutions. What happened to free market solutions? The government did not decide for people to turn in their horse and buggies for cars; market forces did so because they were more efficient. Even so the transition took many years to completely phase out animal power. In spite of all the movies showing the latest in German tanks during WWII most (about 80%) of the logistical “beans and bullets” were still moved by horses and wagons even as late as 1944. This was 40 years after Ford’s model A was introduced onto the market. A shift from IC (internal combustion) engine powered vehicles to EVs will take longer than anyone in government thinks right now. Until some “magic” is discovered soon to make batteries hold more power in a smaller package that is lighter and costs less and charges faster, there is going to be trouble talking people into buying them.

Whatever happened to natural gas powered cars? The existing internal combustion (IC) engines can run on compressed natural gas (CNG) with minor modifications. Fueling stations are not too difficult to build and natural gas is already distributed around the country. Regular gasoline fueling stations could offer natural gas with the addition of a compressor and metering system. Fueling at a commercial fueling station could be done in about the same time it takes to fuel a gasoline car. While people state that compressed natural gas (CNG) is dangerous to handle, I counter that gasoline is equally dangerous and we seem to manage. Finally, we have an abundance of natural gas in the United States so it makes sense to use it here. Regular IC engines that burn natural gas would allow for long trips, which are the main problem with electric cars. Natural gas also burns cleaner than gasoline. Engines also last about twice as long when burning CNG. The cost for CNG per mile is also much less (about half) the cost of gasoline with the present pricing. There are several production cars now that run exclusively on CNG and some that run on both CNG and gasoline. The Honda Civic GX runs on CNG and has almost zero emissions except for carbon dioxide which is the same thing that we breathe out and that trees require for life.

There are over 1 billion (1,000 million) passenger cars and light duty vehicles in service around the world today. Currently there are only about 2 million electric vehicles (EVs) in service around the world. That is only 0.2% of the total of passenger light duty vehicles. There are currently 24.4 million CNG vehicles in use. There are about 5 million CNG vehicles in China, 4 million in Iran, 3 million in Pakistan, 3 million in India, 2.3 million in Argentina but only 0.16 million in the United States. Most of the current growth of CNG vehicles is in the Asia-Pacific region of the world. Right now it appears the problem is that gasoline is just too cheap. If there were more CNG fueling stations and there were tax incentives for CNG cars like there are for EVs then I feel CNGs would be much more popular. I can remember in the early 1960s it was quite common for most light farm trucks to run on butane that is similar to CNG. Most could run on either butane or gasoline and would start on gasoline until the engine warmed up and then would switch over.

Fuel cells that run on hydrogen are not a realistic alternative. Hydrogen and oxygen can be made from water through electrolysis. The process requires electricity and is not economically efficient. Offshore platforms with wind generators can convert seawater to hydrogen and then pipe the hydrogen to shore easier than sending the electricity to shore. Even so, a distribution system would have to be set up to use it in automobiles. It would make more sense to store this hydrogen and use it in power generation to be distributed through the existing power grid than to try to construct a hydrogen distribution system.

Many people have no idea that most natural gas was simply flared off at oil well sites since the discovery of oil to as late as the 1940’s in many parts of the US. The natural gas was a nuisance in most instances and it was flared so the oil could be produced. There was no infrastructure to collect the gas and distribute it for sale. Oil could be easily collected in tanks and hauled to a refinery in trucks or rail tank cars. Natural gas was a bigger problem to collect and transport. Much of the commercialization of natural gas was pioneered in Shreveport. Companies such as United Gas Pipeline Company and Texas Eastern Transmission Company were built upon harnessing the natural gas and bringing it to market. After WWII the Big inch (24”) and Little inch (20”) pipelines were purchased from the US government as war surplus and converted from oil pipelines to natural gas carrying product from the East Texas fields to the Northeastern US for a distance of 1,200 miles. It took unheard of fortunes to slowly create the infrastructure of compressors and pipelines and right-of-ways to make it all happen. Then markets had to be developed to use the natural gas. It is doubtful that it could even be done again in today’s regulatory environment. The fact that we have such a collection and distribution system for natural gas is just one more reason to use it as a fuel for transportation. Not to mention that we currently have such a glut of natural gas that we are trying to send it around the world as we cannot use it all domestically.

I believe that there is not a single solution to the problem of automobile propulsion in the near future. City buses, postal carriers, local UPS delivery vehicles could easily run on compressed natural gas (CNG) from a single central fueling station. Trains could also easily run the on board electrical generators on natural gas instead of diesel to power their electric motor drives. Commuter cars could easily be electric since they have limited range but the real workhorse vehicles that need longer range capability could be a combination of CNG, gasoline and diesel fuels. The true answer is to let the markets decide. Fuel taxes or road use tax could be adjusted based on how clean each fuel burned. Diesel fuel would probably have the highest fuel tax, followed by gasoline, and then natural gas. Right now there is no fuel tax (or road use tax) on electric fuel for electric cars. This probably needs to be adjusted somehow based on miles driven and type of fuel used to produce electricity in your area. If most of the electricity is generated by coal in your area then your indirectly coal fired EV probably pollutes more than you imagine. After all, the road use tax is supposed to be used to build and maintain the highways and should be paid for by those who use the roads. Those who travel more use more fuel and therefore pay more road use tax. Somehow electric cars must be taxed as well to pay for the roads on which they also drive.

Unleash the engineers on the problem and keep the government decrees out of the picture if you want the best solutions. One size doesn’t fit all and multiple solutions for different applications in different areas will present themselves. Top down central planning never works best.

The same can be said of money. Government decreed digits in a computer might not be the best way to store wealth and transact business. Crypto-currencies, gold and silver coins, and other forms of money might work much better. Because of government decree only FRNs (federal reserve notes) qualify for payment of taxes. FRNs are issued by a private bank that was given a license to conjure up money out of thin air. It’s hard to compete with that type of government subsidy.

The government mandarins should get out of the way with their tax credits, subsidies and special privileges’ and let the market decide what works best in both cases.

US Foreign Policy And The Long Game

A couple of weeks ago the lovely Miss Puddy accompanied me to our downtown club for dinner and a talk by Charlie Cook of the Cook Political Report. Mr. Cook gives an insiders view of Washington DC. His current view of the situation is that none of Trump’s agenda is going to get through congress. The fact that he has never held a public office helps him with his base but does not help him with getting his agenda through the congress. Only 9% of his appointments have been approved but only 13% of the possible appointments have been submitted. Trump’s approval rating is around 45% which is quite low for the honeymoon period when he should be getting his agenda pushed through.

If Mr. Cook is indeed correct than there is a chance nothing will really happen until after the mid term elections. Depending on how those go nothing may happen for the entire 4-year term.

One of the most dangerous things that can happen to a US president is for his domestic policy to be thwarted by congress and then he shifts focus to foreign policy where he has more latitude to implement policy unhindered. Add to that the 4th turning (from the book “The Fourth Turning by Strauss & Howe) and a major war could be forthcoming. The cycle is here and it appears the table is all set for major war(s) in the coming years.

Richard Mabury is delighted with this gridlock in government and sites several instances in his latest newsletter where congressmen brandished firearms in 1836; and where Senator Summner was severely beaten on the Senate floor in 1856 and the full on brawl by 30 congressmen in 1858. Maybury is delighted that the federal government is no longer working together as in most of the 20th century when explosive government growth took place. He reflects that as long as the federal government is in gridlock they will be irrelevant while the private sector can flourish and the citizens will be able to enjoy more freedom. I can only hope that he is correct.

When the US government goes abroad with a big stick beating other governments over the head they do not endear themselves to others. Fear perhaps but not endearment. China on the other hand seems to be playing a long game and is busy working deals and strengthening economic ties with its Eurasian neighbors along the “one belt, one road” trade corridor as well as other places around the world.

The department of defense should be re-named the department of offense, as there does not seem to be much defense involved. Political correctness seems to be threatening the US Navy more than its actual enemies abroad. The latest carrier, the USS Ford just launched and was put into service last month without urinals anywhere onboard the ship. It also has a new state of the art catapult that has yet to launch or recover an airplane. To date only helicopters have landed on deck. The magnetic launch system has a few glitches that the old steam catapults had solved years ago. A little magic needs to be invented and then it should work perfectly. Other than the fact that this aircraft carrier cannot launch airplanes its most noteworthy attribute is the cost overruns from 10 billion to around 13 billion (it might be more than 13 as the catapult does not work yet and there is no telling what that “magic” might cost). There will come a time when we no longer can afford to pursue our post WWII foreign policy.

Earlier this summer we heard an IDF General speak at a small gathering. His opinion on the Middle East was the Shias in Iran were at war with the Sunnis in Saudi Arabia. Iran was backing Hezbollah in Lebanon and Israel was quite concerned with all their rockets in Southern Lebanon pointed at them. He said that all homes built in Israel since the mid 1970s have been required to have a safe room constructed in the middle of the house that can withstand indirect rocket attack and chemical attack. With their early warning system he felt that the majority of their population could easily survive a conventional attack. When I asked about China’s OBOR (one belt one road) economic plan through the Middle East and their long-term game plan he said it was not their immediate concern. He did state that he had visited China on many occasions and that the Chinese government was greatly at odds with the US concerning their long-term goals.

It is hard to say but perhaps the Chinese have already beaten us economically in Eurasia and maybe even Africa too. Economic ties through trade and then a common currency make for strong friendships and alliances with close by neighbors.

Perhaps our foreign policy should start to stress stronger economic ties with our own North and South American neighbors. Perhaps start with high-speed rail from Alaska and the Canadian Northeast all the way down to the tip of South America. We could encourage travel to start with and then encourage friendship and trade. Wars rarely break out between trading partners. It just makes so much more sense to work in our own backyard instead of the other side of the world. We should not abandon trade with Eurasia but we should be realistic and recognize that the Chinese have beaten us at many levels thus far. We should double our efforts to reach out to our neighbors as respected equal trading partners instead of 3rd world protectorates and work hard to establish travel and trade and friendship throughout North and South America.

Full “Faith” And Credit

Everyone knows that our “official” US debt is around $20T on our “cash basis” of accounting. When taking all our promised future payments into account and running them back to their present worth then the real US debt is around $80 to $120 T. Considering the total US GDP for an entire year is only $18.5T these numbers are pretty unpayable – EVER. Of course this means only one thing which is default. Sir Alan Greenspan said that we could never default in that we could just print up more dollars, however, printing more dollars and making them worth less is indeed another indirect form of default. The big question is exactly how much longer can this go on?

The bonds of the US government are backed by the “full faith and credit of the government”. It is the “faith in government” that I want to talk about in this article

There are many reasons that drive the price of gold up in terms of dollars, however, the number one reason that will drive it much higher is loss of confidence or “faith” in the government.

Well how is “faith” in government playing out in 2017? Let’s look at just a few highlights:

CONGRESSIONAL APPROVAL RATINGS

The US congress has 100 senators and 435 representatives. Each senator has a staff budget of between $2.5M to $4M depending on state population. Each representative has a staff budget of around $1M and has about 18 employees (plus interns and part timers). Of course committee staffers are on a separate budget. So in addition to our 535 elected representatives in congress there are 12,000+ staff members to assist them in their duties. Before the 1860’s, members of congress didn’t even have offices or staff and worked at their desks in the capitol. Small wonder their approval rating is around 3% now.

SOCIAL SECURITY TRAIN WRECK

Don’t even get me started. Too much ink has been spilled here already. Let’s just say that Charles Ponzi would be embarrassed to try to sell this one. Then they doubled down with medicare just for good measure. Of course we should take care of our elderly but promising the moon without a way to pay for it is hardly taking care of the situation. The sheer numbers will overwhelm it. You just cannot argue with the math on this one – it doesn’t add up. Look for default but along the way look for means testing which will confiscate retirement plans in an indirect manner in an effort to stretch it out a little further before it collapses.

HEALTH CARE

The same people who brought you the post office and the department of motor vehicles now want to control your health care. With advances in longevity just around the corner in a decade or so we can look forward to longer healthier lives. The good news is we will live longer. The bad news for SS & Health Care is we will live longer. The math looks even worse now!

SJW (social justice warriers)

Let’s just say it appears that the adults are no longer in charge.

SUCCESSION MOVEMENTS

Europe has dozens of succession movements in addition to Brexit. The EU is toast and will not last another 5 years in its present form. Several nation states will split up into smaller more manageable smaller states. The US has several successionist movements as well in California, Alaska, Texas, New Hampshire and other areas. If you don’t think it will ever happen just look at the old USSR and see what happened there.

CLIMATE CHANGE AGREEMENT

President Trump pulled out of the Paris agreement on climate control this past week and everyone is in a panic. The entire science of climate change is flawed. The solar 300 year cycle probably has more to do with our climate than any other factor but the PC crowd doesn’t even mention that fact. Look up the $100T dollar banker swindle on YouTube and see what they say about who will benefit from carbon exchanges, carbon credits and carbon rationing.

FUKUSHIMA NUCLEAR DISASTER

I know it is in Japan, but it still affects us here on our side of the pacific. It has been five years and this should be one of the biggest ongoing news stories but most people figure the government has it all under control. Their latest little robot melted down before it could even get inside and take a good look around. Radiation continues to leak into the sea and cause trouble.

MONUMENT REMOVAL

Even our history is being rewritten. We only have ourselves to blame for this one as we did not cry foul years ago when the schools started teaching that old white slave owners started the country and they are not worthy of our respect in any form whatsoever. Too bad our kids don’t study history any more.

DUMP TRUMP MOVEMENT

I have never seen anything like this in my lifetime. The losing side is trying to force out a legally elected president just because they do not like him. My goodness, every election has a winner and a loser. Never has anything like this happened since Lincoln was elected and the South succeeded from the Union. The country is polarized but I am not sure that anyone knows exactly what the issue of contention is exactly other than “Trumpness in general”? The issue that divides us is hard to define.

I don’t mean to just present a short and incomplete laundry list of why our country doesn’t seem to be working any more and leave it at that. If people “feel” that government is not working any more than that becomes their reality. No longer will good men decide to run for public office and serve. Our local county just voted down 5 out of 5 property tax renewals because they felt the local county government was not spending money wisely. Make no mistake in your thinking in that this government will collapse at some time in the future. The first step in a collapse is a general feeling that government is no longer working and is out of control.

The good news is that life will go on after the present government collapses and defaults. Communities will go about their business and things will continue. The big question is what will we put in the old government’s place? What will we replace it with? The time to think about that is now. What would you put on the other side of the collapse if you were in control? Large government got us into this problem so how would you prevent the next one from growing too big?

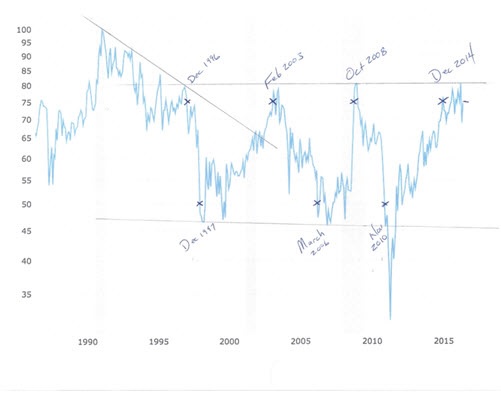

Portfolio Rebalancing in 2016

Volumes have been written on portfolio rebalancing and in spite of that very few people bother to ever rebalance their portfolio. Most people spend more time planning their vacation than they do planning their investments. It really does not have to be that hard. All too often one falls prey to their emotions buying this or that based on a “hot tip” from their brother-in-law. The truth is investing is very boring and requires a great deal of patience. It is difficult to remove all the emotion from the equation. People panic with the herd and end up buying high and selling low unless they have a plan.

One of my favorite movie scenes is from the movie “Caddy shack” where Rodney Dangerfield is on the phone with his stockbroker while playing golf. He says “buy, buy, buy! Oh, everyone’s buying? Then sell, sell, sell…” In spite of the humor that is exactly the opposite of most people’s inclinations. The majority lose money because they let their emotions take over their investment plan.

I recommend taking the time to rebalance once a year. Of course to rebalance you need a plan. After several years many investors end up with no clear plan because they never take time to reevaluate. You can see many of the greatest investors’ plans in the book, “Master the Game,” by Tony Robbins. My personal favorite investment plan is Harry Browne’s famous “all weather permanent portfolio” which was introduced decades ago: 25% stocks, 25% gold, 25% bonds, and 25% cash; rebalance every year and leave it alone.

After many years of trying I have come to the expensive conclusion that I am not a good stock picker. I have had some really good picks in the past, but unfortunately my timing was usually too early. Churning your account is a recipe for loss in most instances. Very few traders make money competing against high speed computerized trading programs. This is where a good plan and disciplined execution comes into play. It is where you can take the emotion out of the equation as best you can. You just need to find a mix that you feel comfortable with and stick to it. For several reasons, the following is my favorite investment allocation plan:

DISCLAIMER ALERT: I am not a financial advisor and this sample allocation is for illustrative purposes only. Any funds invested should only be done after you perform your own due diligence.

25% Precious Metals

10 percent gold bullion // 10 percent silver bullion // 5 percent mining stocks

I like precious metals because they are wealth completely independent of the banking system. They are a vote of no confidence in the government and their ability to operate responsibly. I recommend holding them yourself and not in your brokerage account. If for any reason you simply cannot hold or store your own bullion then I reluctantly advise the Central Fund of Canada (CEF) as a means of holding precious metals. As for the five percent mining stocks, try to stay away from small cap mining companies, as most are long shots that end up worthless. Try a mid cap or large producer, or even a royalty streaming company such as Royal Gold (RGLD) or Silver Wheaton (SLW).

25% Stocks

Even though the US market is overpriced by several metrics, the rest of the world seems to be worse and hot money continues to pour into the US market. I suppose it is seen as a safe haven right now. Since I am not a stock picker I advise 20 percent in Vanguard’s US 500 stock index fund (VTFIAX). It has a very low expense ratio and tracks the US market. The last five percent is where you can go wild and buy some of that stock your brother-in-law said you “have to have.” Five percent gives you enough to play without too much risk. You could put the last five percent in the Fidelity Defense fund (FSDAX). As Richard Maybury says, “War has always been a growth industry in the US.” Not to mention the world seems like a powder keg these days and all the adults are running around with lit matches. If playing in the stock market does not sound like fun then you could put all 25 percent in the Vanguard index fund and forget about it until next year.

50% Cash

Having a high cash allocation gives you the freedom to act on a good deal and take advantage of undervalued opportunities. Without cash you have no power to buy. My father always kept a large percentage of his wealth in cash so he could jump on once in a lifetime opportunities when they came along. I remember an equipment auction in the 1980s where Dad walked in with cash when no one had cash; there were incredible deals that everyoneelse had pass on. He taught me that day that without the capital to act I could watch life-changing opportunities just pass me by. Fortunes have been made buying stocks at extreme market bottoms, but it’s impossible to do so without ready cash. Place your cash in short term US treasuries, bank deposits (always less than $250,000 per bank), and keep on hand at least three to six months expenses (in small bills held outside of the banking system).

Note: High yielding corporate bonds may be something to look at in five to ten years with some of this cash. For now I don’t think the risk in bonds is worth the effort. Bonds are not paying much interest right now. If interest rates go up (they cannot go much further down) then the current bonds will pay very little interest and lose much of their original value.

You will find that your percentage allocations will ebb and flow, some go up and others go down. Once a year sell a bit of the winners and buy some more of the losers; rebalance back to the percentages in your plan. This may seem counterintuitive, but without rebalancing and sticking with your plan your portfolio will get lopsided. Past performance does not guarantee future results.

This is my plan. Spend some time coming up with your own plan, write it down and follow through. Never carve your decision in stone but practice discipline and try to stick with your plan. Sometimes things change and the plan requires adjustment, minor changes when necessary are good. What you are trying to avoid is getting caught up in the short game when you’re playing a long game.

Patience.

By Larry LaBorde

Should I Buy My Dream Home Now?

Dear Fred,

I am writing in response to your question, “Should I buy a bigger house now so that my adult children will have a place to stay when they come home to visit because interest rates are so attractive?”

As you well know there has always been trouble in the world. I have studied cycles in history and as they state in the book, "The Fourth Turning" history is not linear but more like a vertically extended slinky. While history advances, it does so in cycles that run approximately 80 to 100 years per cycle (four generations). The Russian economist Kondratiev in the 1920's came up with the K wave cycle of 50 or so years. Stalin didn’t approve of his work since it did not predict the end of capitalism and had him killed by firing squad in 1938, but that is another topic. Then there are cycles within cycles such as Martin Armstrong's work exemplifies based on a multiple of pi. The Old Testament also talks about seven year cycles and the seven times seven year cycle that results in the 50 year jubilee. The debt forgiveness during the jubilee is necessary to wash out the excess debt buildup in the system. (If you have ever played a very long game of monopoly the banker ALWAYS wins in the end---never forget this when trying to outsmart the bank.)

I feel that we are currently entering into a long term economic winter (20-25 years in duration) as a result of the build up in debt that is currently overwhelming the system. We have tried everything to put it off including changing the bankruptcy laws that make it harder to enter into bankruptcy. We have lowered interest rates in order to allow us to take on and service even more debt. The world's central banks are entering into "negative interest rates" in order to encourage consumer spending and discourage savings. Competitive currency devaluations also tend to discourage savings and encourage spending. People tend to forget that Capitalism at its very heart is about accumulating capital through savings to purchase the economic tools (backhoes vs shovels; factories vs garage industries; trucks vs draft wagons) that allow the overall standard of living to increase for all of society. When Capital is destroyed, squandered on silly public works programs (bridges to nowhere) or misspent on consumer items then there is less to invest in the very powerful capital intensive tools that allow us all to live better through an increased standard of living for all.

Bill Bonner writes that economics has become a complex mathematical discipline in the past 75 years where people in power can just adjust the dials and pull the right levers in congress and at the Federal Reserve and the economy will respond like a machine. The truth is the economy is 7 billion people (a huge living organism) that is beyond the control of a few people. Each of these 7 billion souls is making individual decisions based on their own best interest (as well they should) and that the entire complex world does not respond to the tinkering of a few individuals. God has made us all with free will to live and prosper in an amazing complex society. It is my belief that the purpose of government is simply to provide a very loose framework so that we can all operate within this grand chaos and that it should simply act as a referee so that we do not harm the weak or each other. I believe that economics is more a philosophy and not a science. That being said, we should always watch out for "heard mentality" in society and therefore in economics. As Charles Mackay said, “Men go mad in herds, while they only recover their senses slowly, one by one.” I believe cycles will eventually trump the few men and women behind the curtain trying to operate society as a machine.

Now we come to your question of a long term low interest mortgage on a larger home in today's current economic climate. Dad once said (he was quoting someone and the name eludes me) that there are two ways to deal with the bank. The first is to owe them nothing the second is to owe them 110% of all you own - anywhere in the middle is a dangerous place. Keep in mind that Dad was a banker in the late 1960's. In other words if you owe them 110% of your loan they will work with you and extend you terms and do everything possible to avoid foreclosing on you because they will suffer a loss. If on the other hand you borrow 50% from the bank and put up 50% of your funds you are in a perilous condition. If your investment suffers a 40% loss and you cannot pay they will swoop down, foreclose and sell your property at a discount where they will recover all their capital and you will loose all of your capital. Just keep this in mind.

A home is a normal person's largest investment and it is usually a poor investment when all is factored into consideration, however, you gotta live somewhere. Once you realize that a home is more of a lifestyle choice and less of an investment it is easier to move forward with your decision.

So the big question is, will the banks remain solvent and will the economy muddle along for the next 30 years so that I can pay off my low interest mortgage? Or even better; will the banks remain solvent and will the economy soar in the next 30 years so that I can pay off my fixed interest 30 year mortgage with my lunch money? Only God himself knows for certain but if cycles are correct we are entering (or have entered) into an economic winter. If you feel your jobs are secure and if the banks (nation, economy, currency) will remain solvent for the next 30 years then you will come out on top. There are a lot of unforeseen hazards or black swans that could cause problems on the horizon. In an economic winter all sorts of crazy leaders and theories arise. If you read "The Roosevelt Myth" by Joe Flynn he has one chapter entitled "The Dance of the Crackpots" in which he details all the crazy economic suggestions that were put forth (some were even tried and failed miserably) during the beginning of the great depression during the "first" new deal. The last economic winter brought forth the fall of Russia and the rise of communism, WWI, the great depression, the collapse of world trade and several other major financial upheavals. It is NOT the end of the world, it is just a little economic madness for a while. Eventually people come to their senses (reread the quote above from Mackay), the debt is forgiven and economic spring begins again.

There will always be cycles and we simply have to live in the economic cycle in which we are born. I suggest that you prayerfully consider wise council from multiple sources (certainly do not take what I am saying as the unvarnished truth) and do what you feel is right and gives you peace in your decision. Perhaps look for a great bargain, maybe a smaller fixed rate 10 year mortgage, maybe a place you can buy now and easily add onto later, maybe a larger piece of land with a nice house that will allow room for one or two small guest cottage(s) a little later as finances permit. My only recommendation is to avoid a large long term debt that does not give you any flexibility in the future in case things get difficult.

As Mark Twain once wrote, "I apologize for this long letter but I didn't have time to write a short one."

Your friend,

Larry LaBorde

Master the Game

I recently finished Tony Robbins’ latest book, “Money, Master the Game,” and I highly recommend it. Many of his suggestions in the book are really simple ideas that everyone knows about, but few execute well. Robbins shines as a personal coach and motivator; he has a good way of taking these ideas and turning them into powerful, effective action steps.

In true motivational style, he guides his readers to visualize a future at different levels of wealth. He then directs the reader to his website where a series of questions allows one to see and outline explaining whether those levels of wealth are or are not attainable on this new trajectory. He shows us how to dream and envision ourselves in a great future and then teaches the reader how it can be obtained. He reveals how everyone can save and invest for the future with a plan. Even the most skeptical reader will see where a little funding can be found to start your retirement account right away if you want it bad enough. He then directs the readers’ attention to where even more funds can be added along the way without too much pain. He poses the question then provides a pretty satisfying answer to one of the biggest secret fears of my boomer generation, “will I outlive my savings?”

In the book he covers such topics as: managing risk, portfolio rebalancing, asset allocation, reducing fees, saving more and rewarding yourself along the way. While the book is written for beginners and covers basic terms he also gets into structured notes and market linked CDs (certificates of deposit) that protect your downside risk as well as REIT (real estate investment trusts) on assisted living centers that allow you to capture the real estate upside as well as the upside of the business end of the center all while reaping the depreciation tax benefits. He discusses the benefits of hiring fiduciary experts and the fees they charge as opposed to listening to your broker’s advise.

In “Money, Master the Game,” Robbins suggests the reader watch a video by Ray Dalio. It is a 30-minute mini-movie, “How The Economic Machine Works,” which does an excellent job explaining the business cycle. I highly recommend that you invest 30 minutes of your life watching this short simple video at www.economicprinciples.org. This was one of my favorite gems from the book.

Robbins goes on to interview Ray Dalio, of Bridgewater Fund fame, in the book and that interview alone is worth the price of the book. Dalio’s “all seasons” portfolio is a “set it and forget it” fund (except for yearly rebalancing) that is quite easy for the average investor with mostly ETFs and index funds. I won’t spoil it for you, but Dalio recommends a 7.5% gold allocation in his mix. In a shameless self-promotion I invite you to visit www.silvertrading.net to fill this allocation in your portfolio!

An investment portfolio can be as simple or as complicated as you wish. The beginning investor should not feel overwhelmed as you can make a simple plan and get a good return. Or the more sophisticated investor can make a more complicated plan and get a bigger and better return. However you handle your retirement planning I believe you can glean quite a bit of useful information from this book. For example Robbins goes into detail about the good, the bad, and the ugly concerning annuities and PPLI (private placement life insurance), he also talks about index funds.

Near the end he supplies personal interviews with a dozen of the greatest investors of the last few decades. My favorite was an interview with Marc Faber, who has hosted the New Orleans Investment Conference a few times and is a delight in person. He finishes strong with how bright the future really is due to technology and man’s relentless push forward, as well as his personal secret to living (it’s pretty simple but you have to buy the book to find out).

So there you have it: how to make a great plan, motivation to execute that plan, good stories, and a happy ending. What more could you want in a book? There’s a reason it’s a best seller. Enjoy!

by Larry LaBorde

What This Country Needs Is a Good 5 Cent Nickel

If you go to the website, www.coinflation.com today you will find that the composition of a nickel is 75% copper and 25% nickel. Originally only silver dollars were real money at .77 troy oz of silver per dollar. Dimes, quarters and halves were 90% silver just like the silver dollar but 2 halves, 4 quarters or 10 dimes only had .715 troy oz of silver. The difference was seignorage or the cost of making the smaller units. The lowly penny and nickel were mere tokens that were not really worth anything near their commodity value.

In 1965 due to LBJ’s guns and butter programs 90% silver coinage was removed from circulation because the commodity value of the coinage exceeded the face value. Dimes and quarters became tokens and Kennedy halves were reduced to 40% silver for a few more years until they to became mere tokens as well. Today all commonly circulated coins are just tokens. However, the old pre 1982 penny with a copper content is now worth a little over 2 cents. The new penny that is 97½% zinc has risen to almost 60% of its face value. The commodity value of the nickel is now almost 90% of its face value.

Back in 2011, Texas billionaire, Kyle Bass purchased 20 million nickels that at the time had a commodity value of $.068/each. In other words he invested one million dollars that was worth $1.36 million dollars with a downside floor of 1 million dollars. When the Federal Reserve asked why he wanted 20 million nickels he is rumored to have replied, “I like nickels”. Today those nickels have a commodity value of only 0.896 million dollars, however, he can always deposit them at the bank for 1.0 million dollars at any time. Not a bad investment. No downside – only upside.

In several countries around the world there have been overnight currency devaluations where say 10 old units were worth 1 new unit the next morning to everyone’s surprise. The new paper dollar or peso or whatever was usually a different color than the old paper currency. The banks just adjusted everyone’s balance and the general population was given a brief period of time to turn in the old currency for the new currency at a rate of 10 to 1 before the old currency became completely worthless. Normally when this happened the coinage never changed. It was just too difficult to call in all the loose change and re-mint it in a new design. So if 10 coins equaled one old paper currency unit before the devaluation then the same 10 coins equaled one new paper currency unit after the change over. There just was not enough change out there to worry over so if you had your savings in hard change in milk jugs sitting around the house you were OK. However, if all your savings would fit in a few milk jugs then maybe you were not OK after all.

The US Mint will probably catch on pretty soon and change the metal composition in nickels to all zinc or maybe even cheap steel. There has been talk of discontinuing the penny and the nickel altogether and just rounding up or down to the nearest ten cents. Gresham’s law will kill the present nickel one way or another.

In the meantime, for those of you who have a little extra room in your safe and are too lazy to bolt it to the floor just add some weight to make it harder to cart off in the middle of the night. Just ask your friendly banker for a $100 box of nickels (2,000 coins) that weighs 22 pounds and is the size of a small shoebox. You may want to tell him you will want one every week and to please have one ready for you. If copper and nickel go back up to 2011 prices each $100 box will be worth $136 (who says the bank doesn’t pay interest any more?). At worst you can bring them back and deposit them in your account for what you paid for them. At best……....well you and Kyle Bass can figure that one out.

by Larry LaBorde

Is It Time to Buy PM’s?

I am often asked the above question several times each day. It looks like a triple bottom is shaping up in the near future. Gold is getting close to its cost of production. The gold/silver ratio is going higher indicating that silver is the better value of the two at present. But sitting back and taking a look at the big picture consider the following top 10 list:

- Growth of the Federal Government. The followers of Lord Keynes have the controls of power firmly in hand. A larger central government = larger central power (central planning) = larger drag on the real economy. Ask any small businessman (if you can still find one) about the costs of taxes, regulations and licenses.

- Federal debt. Extinguishing debt is mathematically impossible with our system of money / debt. The biblical Jubilee called for all debt to be cancelled every 50 years so that excess debt could be washed out; otherwise one person would end up owning everything with enough time. Our federal debt is officially listed as $18.2T based on a cash accounting system. (Based on GAAP the debt is estimated at $100T more or less.) Our entire yearly federal budget is only $3.8T. Our yearly national GDP is only $17.5T.

- Private / corporate debt. Since 2007 private, corporate & financial debt is down by about 50% of GDP. However, the federal government has increased their debt by about 33% of GDP. While most households and businesses are trying to get their financial houses in order the federal government debt is rocketing higher (classical Keynes reaction). All this additional public debt is causing a drag on the real economy. If interest rates rise from the present record low rates we will find ourselves in big trouble. That is a bet I would not make.

- Derivatives. Speaking of debts that I would not make concerning interest rates the worldwide derivative market is estimated to be around $1,000T. The top 5 US banks hold around $290T. Most of these derivatives (or bets) are based on interest rates. Just for the record, $1,000T is about 14 times the total world GDP. Hopefully all the counterparties will remain solvent if interest rates rise and it all unravels in an orderly fashion (LMAO).

- Casinos and Mega-banks. The local intra-county banks of my childhood are mostly all gone. Banking is a special privilege where money is created through the process of loaning it into existence. Therefore intra-county banking was only allowed because the profits from that magic were supposed to stay in the local economy. Mega-banks in New York suck the life out of local communities and transfer that wealth out of town at the end of every day. Casinos pretty much do the same thing in most communities. The house take on all gambling pretty much leaves town every night minus a little local payroll and local taxes. Both casinos and mega-banks suck the lifeblood out of communities given enough time. The too big to fail banks are also now even bigger and have become too big for bailouts. Watch out for bail-ins in the future (as per IMF recommendations).

- Monetary policy. The current zero interest rate policy or ZIRP has allowed the federal government to expand its debt load, however, the unintended consequence is that savers have been forced into speculation. Years ago middle class workers saved at the local bank and received interest of 5% or so in passbook savings accounts and a little more with certificates of deposit in time accounts. The ZIRP has forced these savers into speculating in the stock market in search of yield. Furthermore the competitive currency devaluations between countries are a race to the bottom. No country in the history of the earth has ever achieved long-term prosperity by devaluing their currency. This is simply insane and will result in inflation or worse when velocity finally increases.

- Central bank balance sheets. The federal reserve balance sheet has ballooned to around $4.5T (no telling how much of that is worthless). The IMF (the central bank’s central bank with Christine Lagarde at the helm) can generate fictional SDR’s at will (currently worth about $1.5/each). Their balance sheet is only around $0.5T so there is room for expansion here it seems. Look for more money (not wealth) to be generated at the IMF in the future.

- US stock market. The p/e ratio of the Dow 30 is getting a little high which says a correction is in the air. This may take longer to come about since with all the trouble in the world the US is still seen as a safe haven and people in troubled parts of the world like to park their wealth here in times of uncertainty. Just for a better feel for the numbers the market cap or total value of Apple is $0.6T. The total market cap of the largest 50 US corporations is around $10T.

- Foreign intervention. George Washington warned us against “entangling alliances”. Eisenhower warned us against the “military industrial complex”. General Smedley Butler said the US Navy should not be allowed more than 600 miles from the coast of the continental US and that we should have the strongest DEFENSIVE military ever to protect our shores. In an effort to prop up the USD we have ignored them all. At present it seems that we are trying to reignite the cold war with the Russians. Pipeline politics has become the mission of the State Department. The BRICS nations seem to be aligning against us economically as a result of our misguided foreign policy.

- 10. But the number one reason to buy PM’s now is simply because you still can get them. During the 2007 / 2008 crisis the PM market seized up. Bullion dealers in the US had to suspend trading because orders had backed the system up and we had to wait days for it to clear before we could take further orders.

by Larry LaBorde

Crew’s Log

I just returned from a guy trip. Most who know me are aware that I have played on sailboats for the last 35 years. I have done a little cruising in the BVI, the Great Lakes, both coasts and several inland lakes. We also raised our children racing as a family on several kinds of boats, primarily Thistles, all around the country. But this time was different. I sailed from the Chesapeake Bay to the Bahamas in one hop – six days and five hours – with a couple of guys. Really, it was more than a sail, more than a simple guy trip; it was an adventure and I’m sure glad I said yes.

It all started after one of my son’s high school classmates read my last article and just happened to be back in town. The lovely Miss Puddy and I taught him, and his twin brother, in Sunday school 30 years ago. Who knew we would meet again as adults and go on an adventure together? In his previous life Captain Tim had traded energy futures, worked for a hedge fund and then disillusioned by the whole sorted business just sailed away to the Caribbean on his 36-foot sailboat. After a few years of leisure cruising he landed in the Dominican Republic for a while. He returned to Louisiana via South Africa this spring and after he happened upon my latest column on the Internet he gave me a call. We had lunch and talked sailing. He mentioned that he might be bringing a boat to Bermuda for a friend. Another skipper would ferry it down to the Dominican Republic for the second half of the trip. Somehow I let slip that if he needed help with the transport to just give me a call, as I had never sailed on a long North Atlantic trip.

A couple of weeks later an email appeared in my inbox from Captain Tim asking if I wanted to go to Bermuda. After about two seconds of consideration I tapped out “yes!” And so it began…

Captain Tim flew ahead and checked out the boat for a week or two. I scheduled a little time off work while we waited for a one-week weather window to depart.

The following is an account of my blue water adventure:

Thursday April 17th:

The trip is on for the middle of next week. Buy airline ticket and be in Richmond, VA, next Tuesday. My sweet wife happens to leave today to visit our daughter and new granddaughter in Michigan.

Friday April 18th:

Dig out my son’s foul weather gear just in case I need it on the trip.

Saturday April 19th:

Home alone with the dogs. Taking care of last minute business details all day.

Sunday April 20th:

Wash any clothes that I need and start a short list of items to pack.

Monday April 21st:

At the office all day squaring things away. Tell everyone I will be gone four or five days. Come home; realize that I really should pack. Cannot find old duffle bag so made a late night run to Wal-Mart to buy soft luggage for the boat.

Tuesday April 22nd:

Fly to Richmond and meet Captain Tim at the airport. He tells me there is a change in plans (first of many). The boat owner wants us to go to the Bahamas instead of Bermuda, as the insurance surcharge would be an extra $5,000 for going so far offshore. We stop by the grocery store to provision the galley.

Wednesday April 23rd:

Gregg drives down from the upper Chesapeake Bay area to join us as our third. We make a quick trip to the local West Marine for last minute items. Run last minute checks on the 2007 49-foot Beneteau sailboat and make sure we are ready to depart early tomorrow morning. We have several beers at the dock to celebrate our impending departure.

Thursday April 24th:

We’re up early and cast off around 7:00 am and slowly motor out of the harbor and into Chesapeake Bay. It’s quite cool but the water is pretty flat. We motor through the channel, dodging traffic and getting used to the navigation system. The navigation system has all the charts with navigation aids incorporated into the system with GPS tracking on the chart. This is all saved to the autopilot and displayed on a 12” screen at the helm. We raise the sails and cruise past Hampton, Newport News, and Norfolk, then over the Chesapeake Tunnel and into the Atlantic. As we round Virginia Beach and I go below and prepare salad, baked potatoes in the gimbaled stove and pan-fried rib eye steaks on the range for our first dinner at sea. Everything is great and I’m getting a bit of experience cooking on a gimbaled oven/stove in the little galley. It’s sort of like the Airstream (going up and down a very bumpy road with several tight curves). The winds are about 10 to 12 knots and we’re making seven knots or so under sail. It has been a great first day. We decide to take four-hour night watches. Captain Tim takes the first watch from 8:00 pm until midnight, Gregg decides on the second watch from midnight until 4:00 am and I volunteer for the last watch from 4:00 am to 8:00 am. The plan is for us all to keep an eye on things during the day, but only one person up on deck at night so the other two can sleep.

Friday April 25th:

It’s cold on my watch so I wear a thermal layer beneath my foul weather gear while on deck. The autopilot drives the boat, but we make minor course corrections for the wind changes to keep sailing on course. The sunrise is quite spectacular. Shortly after sunrise several large fishing boats come charging out of Cape Hatteras heading due east while we round and then turned slightly Southwest along the North Carolina coast. We still have cell phone coverage so I call Puddy and report our position, speed, and direction. I take a short nap and awake to “the washing machine”. The wind has picked up to 20 knots and the seas are angry. The boat pitches up and down, side to side and then yaws (all at the same time). Captain Tim complains that this particular boat doesn’t seem to have enough handhelds above or below. My bruising starts today. It seems every corner in the galley, at the navigation station and in the head is out to hit my hips and/or legs. I relearn how to walk in a strange sort of dance trying to keep my feet under my body as the boat moves beneath me in a random, unpredictable manner. The canvas bimini cover rips and tears away from the frame. I cut away the remaining canvas, trying to keep my balance while wielding a sharp knife. We have jack lines on the boat, this means I’m wearing a harness with a lanyard connected to the life line so I won’t fall overboard in the storm. However I could fall and hit any number of other things in the process and acquire yet another bruise (did I mention I am holding a sharp knife and standing on the transom of a boat pitching violently?). Later that afternoon after sailing for 35 years I experience my first bout of seasickness. So this is what my sweet little wife complains about whenever she forgets her medicine. Not even a ginger snap on the boat. Just suck it up, skip dinner and go to bed early. I wedge myself into my bunk to keep from rolling around and fall asleep exhausted. Tonight my dreams consist of jumping ship and swimming to shore at Myrtle Beach, or maybe Charleston.

Saturday April 26th;

Up at 4:00 am for my watch, feeling a little better. We have just cleared Cape Fear. The shoals go out quite a bit east of the Cape and we are trying to keep a safe distance from their wrath. There are also shoals south of the cape that we try to avoid in the dark, just to be safe. On deck Gregg has made several tacks trying to clear the shoals south of the cape but the wind is being difficult. Captain Tim suggests we forget about following the coast down to Charleston. The wind has shifted southeast and we will be head to the wind down to Charleston. So we change course and head due south out into open water. The moon is low and bright on our port hip. The stars are out in a clear sky and visibility is pretty good tonight. The wind is up and it’s a close reach headed south. The boat sails like a dream in light seas. It is possibly the best sail of my life. After Gregg and Tim go back to sleep I am alone on deck and all is right with the world. The sun comes up and it is a beautiful day. I grab a short nap after my shift. I wake up and get a bowl of granola cereal with blueberries and go up on deck. A large sea turtle swims by headed north against our course. We have entered the Gulf Stream and have turned from due south to southeast in order to get across it quickly. The current is about 2-3 knots and is trying to carry us back North. We’re out of the Gulf Stream before nightfall and turn back South. I break out the satellite phone and call Puddy to give her another position, course, and speed. Captain Tim cooked chili this afternoon which is perfect as my stomach is finally ready for a full meal.

Sunday April 27th:

Up at 4:00 am for my watch. Seas have picked up and Gregg has spent his watch sitting under the dodger with his feet on the companionway steps. Big lightning storm in progress off the port bow a few miles off. Gregg said it was all around us earlier during his watch. The boat is pitching pretty good so I follow Gregg’s lead and sit in the front of the cockpit on the companionway and jam my feet on the corners of the top step and hold on tight for four hours. Thankfully the autopilot does not kick out and I’m able to stay fairly dry under the dodger. I watch the stars through the starboard side of the dodger and they remain in roughly the same place. The moon stays on my port hip so we are still moving in the same direction for four hours. I pray, I sing hymns, I sing any and every song that I can think of tonight. My stomach is now used to the sea and behaves. I eat a quick breakfast after my shift and catch a short nap. By the time I awake from the nap the storm has blown over. A pod of a dozen or so dolphins swims with us for an hour or more. I cook the last rib eyes and prepare the last of the salad for an early dinner. I call Puddy on the satellite phone once again and reported our position, speed, and direction. We are about 300 miles East of Jacksonville, FL. Since we are now well out to sea I start marking our position on the paper chart at the nav station once or twice a day just in case the electronic nav system fails. We stay up late and talk this evening as the winds have dropped and it’s pleasant on deck. We talk about sailing and we talk about the state of the economy and we talk about our lives in general. I’ve always appreciated how well you really get to know someone on a small boat. I turn in around 11:00 pm.

Monday April 28th:

Up again at 4:00 am for my watch and the seas are kind. The wind is about 15 knots and we’re tacking our way due south, back and forth every few hours. Just before my shift is over Captain Tim comes up and we decide to tack the headsail. I set the autopilot to tack and man windward wench, while Captain Tim is at the leeward wench. Halfway through the tack the headsail catches the mast spreader and RIIIIIIIPPPPPP. The sail tears a four-foot gash along the seam right at the mast spreader. We quickly furl the headsail before it’s damaged further from the wind. Without the headsail we cannot sail on the wind closer than 70 to 80 degrees. We start the little Yanmar diesel and begin to motor due South straight into the wind. We’re making decent time at about three and a half to four knots. Did I mention the owner only has one headsail on the boat? We can’t find a sewing kit anywhere onboard. We have over 100 gallons of fuel left so we should be okay. There is only about 200 miles to go. I cook red beans and rice with sausage for dinner and we stuff ourselves with the last of the fresh food. After today we are going to have to hit the dry rations. We talk of movies and Captain Tim mentions the boat has a copy of “Fight Club” in its inventory. As I have never seen it and the seas are light we decide to have movie night down below while Tim runs up and down on his watch. Great movie but I will need to watch it again after the surprise ending. Go to bed running the movie back through my head trying to remember the earlier parts and make sense of them.

Tuesday April 29th:

Up at 4:00 am and the little engine that could is still chugging away. If everything holds together for another 24 hours we should make it to the Bahamas. I watch the oil pressure and engine temperature like a hawk. Everything seems fine. I go over our options if the engine does quit for some reason and we can’t get it restarted. Since the wind is out of the south we could raise the mainsail and put the boat on a beam reach and just head west. The Gulf Stream would catch us and carry us north a bit since we would be moving slow but we should reach landfall somewhere around South and North Carolina… in about three days. We should have enough dry food to hold us over and there is plenty of fresh water. We would not complete our trip but we would be fine if the wind held up. The little Yanmar engine just keeps on keeping on throughout my watch. This early morning is a fine morning and as I sit at the wheel I thank God for just how lucky I am. I’m on a great trip, have a wonderful wife and family, and have lived a great life so far. I feel truly blessed.

Since we left we have been trailing a fishing rod with a single trailed line. As it just so happens… today, the very day we have run out of fresh food, we catch an eight to ten pound Mahi-Mahi! We carefully reel the fish into the boat, pour some gin on its gills and it quickly and mercifully dies on the deck after only a second or two. We set to work on our catch and cook half for lunch then the other half for dinner. We are miserably full all day, what a great fish. God provides just when we most need it. I call Puddy on the satellite phone and report in at about 50 miles north of the Bahamas and then I fall asleep.

Wednesday April 30th:

Up at 4:00 am for my watch. Our watches are becoming a part of our body clocks. We have reached the outer banks of the northern part of the Bahamas. I motor around the northeast edge in the dark, being careful to stay at least 12 miles off the reefs, until we reached Whale inlet where we should sail through the reefs and into the shallow waters of the Bahamas at dawn. The chart shows the current seas to be thousands of feet deep. Just an hour or so before daylight I turn 90 degrees to starboard and head straight for Whale inlet. The sun is up as we near the inlet around 8:00 am. The depth gauge shows the bottom quickly rise and all of a sudden we were through the cut and the ocean floor was only 25 feet below us. We sail toward Marsh Harbor on Grand Abaco Island for about four hours on a shallow sea of crystal clear glass smooth waters only 10 feet deep. The Bahamas at last! The little engine that could has held out for us with plenty of fuel to spare. We radio the harbor and are assigned a slip.

After six days and five hours we tied up on the dock and set foot on land once again. We brought our passports to the office and they called a customs officer to come by and check us into the country. The dock master suggested we wait in the bar and have a few drinks and a snack since it might be an hour or so before she arrived. The customs officer came to the bar and welcomed us into her country, examined our forms and stamped our passports right in the bar. There were no metal detectors, no lines, no automatic weapons, and no silly questions trying to trip us up. Captain Tim then walked out on the pier and showed her the boat and that was that. The Bahamas is such a civilized country! We celebrated our passage and toasted the Yanmar diesel engine several times. I booked my flight home in the bar for the next day but vowed to return and sail around the Bahamas with Puddy and enjoy the smooth waters with her another time. I showered ashore and finally shaved a week’s worth of grey beard. We had ribs with new friends we met from South Africa at the bar across the harbor that night and then the next morning I was off at the airport and my adventure was over (except for the trip home by air, but that’s another more boring story).

It has been a couple of weeks since I returned and I still have a goofy grin all over my face whenever I think back on my sail. We sailed through rough seas and storms and beautiful sunrises and sunsets. Even a 49-foot boat can seem small in the middle of the great North Atlantic at night with a vast sky full of stars. It can be a very humbling experience. You also learn to fully trust someone when you hand over the helm to your crewmate during a storm and go below and fall asleep. You depend on each other and God to get your through the storms. I suppose it was not that dangerous, but at the time it felt like we were living on the edge.

In a world where we could spend days reading about out of control government spending, too much debt and the economic collapse that is sure to come it is easy to forget to live our lives one day at a time. Most important of all we must remember to enjoy every day as a unique, personal gift from God. So make out your bucket list and start checking items off!

by Larry LaBorde